15-Aug-2023 Source: Archer Aviation

Archer Aviation Inc. (NYSE: ACHR), a leader in electric vertical takeoff and landing (eVTOL) aircraft, announced operating and financial results for the second quarter ended June 30, 2023. In tandem with earnings, Archer made a series of announcements that reinforce its path to FAA certification and commercial operations in 2025. Archer has landed a $215 million equity investment from industry leaders Stellantis, Boeing and United Airlines, as well as other financial institutions, including ARK Invest, increasing the company’s total funding to over $1.1 billion to date, received FAA approval to begin flying its Midnight eVTOL aircraft, and reached an agreement with Boeing and Wisk to enter into an autonomous flight collaboration and settle litigation between the companies. Additionally, Archer announced that it is on track to complete what it believes will be the first ever eVTOL aircraft delivery to a customer as part of its recently announced contracts with the Department of Defense (DoD). These announcements come on the heels of the FAA Administrator leaving to join Archer and the DoD awarding Archer the largest total contract value of any eVTOL company.

Archer issued a shareholder letter providing additional details on these updates along with its second quarter operating and financial results and third quarter 2023 estimates. The shareholder letter is available on its investor relations website here. Archer has updated its earnings conference call time to 3:00 p.m. Pacific Time (6:00 p.m. Eastern Time) today. Attendees can access a live webcast on our investor relations website at investors.archer.com or the conference call by dialing 844-200-6205 (domestic) or +1 929-526-1599 (international) and entering the access code 938837.

“Over the last quarter, we’ve seen the U.S. government make an unwavering commitment that America will lead the way in commercializing eVTOL aircraft, the FAA validated the timeline for eVTOL aircraft to begin operations in the U.S. in 2025, and leaders in the mobility industry, Stellantis, United Airlines and Boeing, have come together to invest in Archer’s future,” said Adam Goldstein, Archer’s Founder and CEO. “The pace at which our industry is advancing is unprecedented. Our team’s hard work and dedication have brought us to this exciting moment, and we can’t wait to see Midnight soar,” added Goldstein.

Archer Aviation Secures $215M Investment

Led by Stellantis, Archer’s long-term strategic partner, Archer today announced it has further strengthened its liquidity position with a $215 million equity investment round. This investment round includes an acceleration of $70 million from Stellantis under the strategic funding agreement entered into in January 2023, with $55 million remaining available under that facility. The commitment from Stellantis has been unrivaled, from its foresight to provide the manufacturing expertise and capital needed to accelerate Archer’s business objectives, to the strategic vision and steadfast support from CEO Carlos Tavares and Chief Engineering and Technology Officer Ned Curic.

The roster of investors from this latest funding round also includes United Airlines and industry giant Boeing, as well as other financial institutions, including ARK Invest. The funds from this round are intended to be used for working capital and general corporate purposes, including Archer’s continued development of its aircraft and related technology, as well as the build out of its manufacturing and test facilities.

Boeing, Archer, and Wisk Reach Agreement to Enter into Autonomous Flight Collaboration and Settle Litigation

Archer and Wisk, leaders in the advanced air mobility industry, along with The Boeing Company, announced a collaboration that looks forward to the growth and development of the AAM industry. Simultaneously, the parties reached a settlement to resolve the federal and state court litigation between them. This collaboration puts Archer in a unique position — to be able to source autonomy technology from a leader in the industry. Over the long term, autonomy is seen as one of the keys to achieving scale across all AAM applications, from passenger to cargo and beyond.

This strategic relationship will leverage each company’s respective strengths and competencies with the goal of accelerating the commercialization of autonomous flight. This approach is a natural extension of Archer’s overall strategy of focusing its in-house research and development on the key enabling technologies that cannot be sourced from the existing aerospace supply base, thereby helping Archer potentially avoid hundreds of millions of dollars of spending.

FAA Issues Midnight Aircraft Certificate to Begin Flying

Archer today announced that its Midnight aircraft received its Special Airworthiness Certificate from the Federal Aviation Administration (FAA). This certification signals that Archer’s Midnight aircraft has successfully met all FAA safety requirements allowing it to begin flight test operations, which Archer expects to commence in the coming weeks.

Archer continues to make strong progress on Midnight’s certification program with the FAA in support of the company’s planned entry into service in 2025. This is an important step as Archer readies to begin its piloted “for credit” testing of its Midnight aircraft with the FAA in early 2024 and bring online the world’s first high volume eVTOL production facility in Covington, Georgia in mid-2024 alongside Stellantis.

As part of Archer’s recently announced landmark agreements with the Department of Defense valued at up to $142 million, Archer announced today that it is on track to deliver the Midnight aircraft to the U.S. Air Force later this year or early next year. Archer believes this would make Midnight the first ever eVTOL aircraft delivered to a customer.

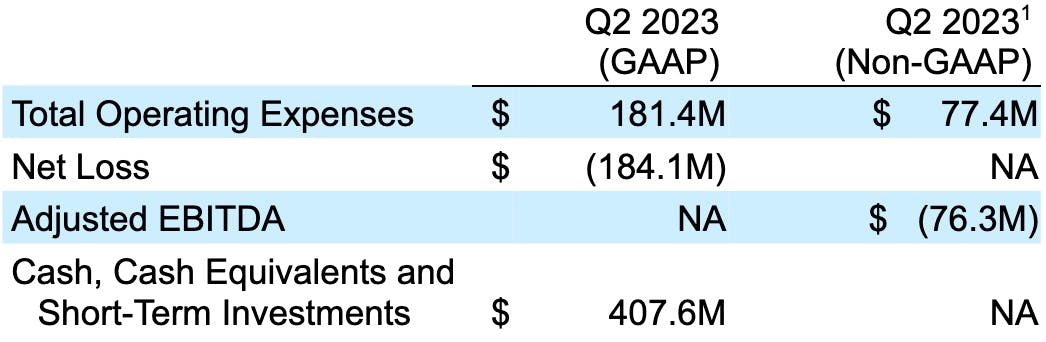

Second Quarter 2023 Financial Results

Third Quarter 2023 Financial Estimates

Archer’s financial estimates for the third quarter of 2023 are as follows:

We have not reconciled our non-GAAP total operating expense estimates because certain items that impact non-GAAP total operating expense are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense is impacted by the future fair market value of our common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2023 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of non-GAAP total operating expenses is not available without unreasonable effort.

Forward Looking Statements

This press release contains forward looking statements regarding our future business plans and expectations, including statements regarding our estimates for the third quarter of 2023, certification timelines, our timelines for the development and delivery of our Midnight aircraft, potential contract value with the DoD, timing of the closing of the equity investment round and use of proceeds, and expected collaborations and cost savings related to autonomy technology. These forward looking statements are only predictions and may differ materially from actual results due to a variety of factors. The risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed in Archer’s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which are available on our investor relations website at investors.archer.com and on the SEC website at www.sec.gov. In addition, please note that any forward looking statements contained herein are based on assumptions that we believe to be reasonable as of the date of this press release. We undertake no obligation to update these statements as a result of new information or future events.

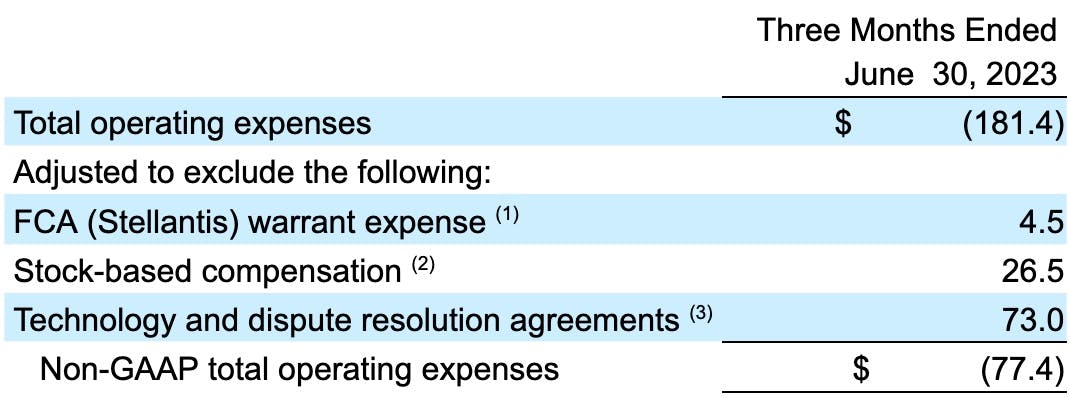

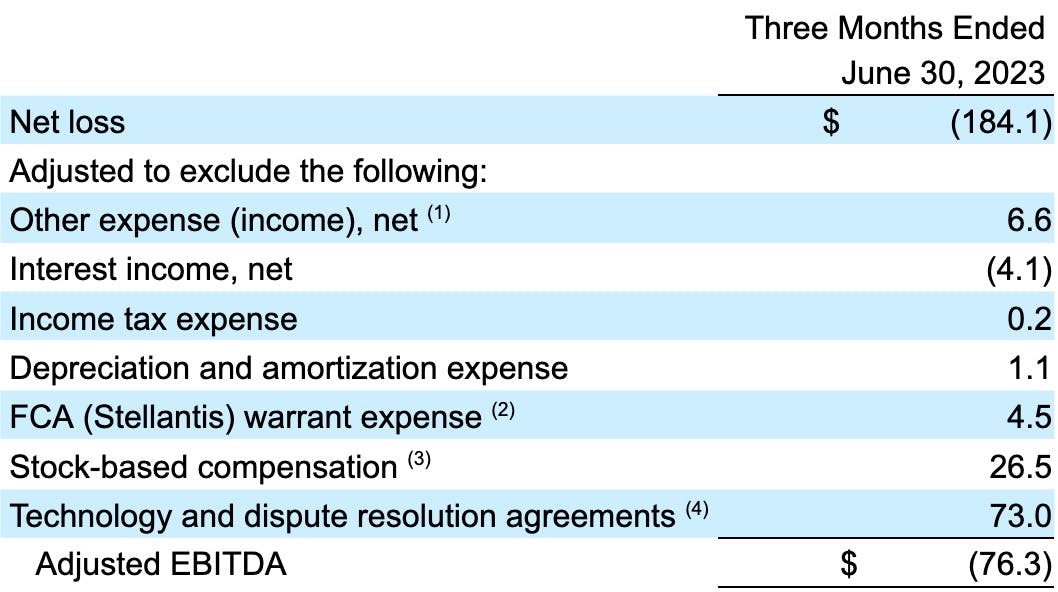

Reconciliation of Selected GAAP To Non-GAAP Results for Q2 2023

Reconciliation of Total Operating Expenses (in millions; unaudited): A reconciliation of total operating expenses to non-GAAP total operating expenses for the three months ended June 30, 2023 is set forth below.

Reconciliation of Adjusted EBITDA (in millions; unaudited): A reconciliation of net loss to Adjusted EBITDA for the three months ended June 30, 2023 is set forth below.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial results prepared in accordance with GAAP, we use a number of non-GAAP financial measures to help us in analyzing and assessing our overall business performance, for making operating decisions and for forecasting and planning future periods. We consider the use of non-GAAP financial measures helpful in assessing our current financial performance, ongoing operations and prospects for the future as well as understanding financial and business trends relating to our financial condition and results of operations.

While we use non-GAAP financial measures as a tool to enhance our understanding of certain aspects of our financial performance and to provide incremental insight into the underlying factors and trends affecting our performance, we do not consider these measures to be a substitute for, or superior to, the information provided by GAAP financial measures. Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial statements provides useful supplemental data that, while not a substitute for GAAP financial measures, can offer insight in the review of our financial and operational performance and enables investors to more fully understand trends in our current and future performance.

In assessing our business during the quarter ended June 30, 2023, we excluded items in the following general categories from one or more of our non-GAAP financial measures, certain of which are described below:

Stock-Based Compensation Expense: We believe that providing non-GAAP measures excluding stock-based compensation expense, in addition to the GAAP measures, allows for better comparability of our financial results from period to period. We prepare and maintain our budgets and forecasts for future periods on a basis consistent with this non-GAAP financial measure. Further, companies use a variety of types of equity awards as well as a variety of methodologies, assumptions and estimates to determine stock-based compensation expense. We believe that excluding stock-based compensation expenses enhances our ability and the ability of investors to understand the impact of non-cash stock-based compensation on our operating results and to compare our results against the results of other companies.

Warrant Expense and Gains or Losses from Revaluation of Warrants: Expense from our common stock warrants issued to United Airlines and FCA US LLC (a subsidiary of Stellantis) which is recurring (but non-cash) and gains or losses from change in fair value of public and private warrants from revaluation will be reflected in our financial results for the foreseeable future. We exclude warrant expense and gains or losses from change in fair value for similar reasons to our stock-based compensation expense.

Technology and Dispute Resolution Agreements: Expense reflects non-cash charges relating to the Boeing Wisk Agreements.

Each of the non-GAAP financial measures presented in this release should not be considered in isolation from, or as a substitute for, a measure of financial performance prepared in accordance with GAAP and are presented for supplemental informational purposes only. Further, investors are cautioned that there are inherent limitations associated with the use of each of these non-GAAP financial measures as an analytical tool. In particular, these non-GAAP financial measures have no standardized meaning prescribed by GAAP and are not based on a comprehensive set of accounting rules or principles and many of the adjustments to the GAAP financial measures reflect the exclusion of items that are recurring and may be reflected in our financial results for the foreseeable future. In addition, the non-GAAP measures we use may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information in the reconciliation included in this release regarding the GAAP amounts excluded from the non-GAAP financial measures. In addition, as noted above, we evaluate the non-GAAP financial measures together with the most directly comparable GAAP financial information. Investors are encouraged to review the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures included in this release.